Menu

Search

START TYPING AND PRESS ENTER TO SEARCH

National Capital Region Transport Corporation (NCRTC) is mandated for designing, developing & implementing the Namo Bharat project across the National Capital Region thereby ensuring and promoting balanced and sustainable urban development through better connectivity and access.

For ensuring financial sustainability of the Namo Bharat project, NCRTC has been exploring avenues for increasing non-farebox revenues, both from conventional and innovative methods by benchmarking domestic and international best practices. The innovative initiatives include implementation of Transit Oriented Development (TOD), Land Value Capture (LVC) and Value Capture Financing (VCF).

The Asian Development Bank (ADB) is providing support for the implementation of the Delhi – Ghaziabad – Meerut Namo Bharat Corridor. Under the Urban Climate Change Resilience Trust Fund (UCCRTF), a technical assistance program has been designed with the objective of providing technical expertise to NCRTC, for augmentation of Non-Fare Box Revenues including implementation of TOD and VCF.

Urban Mass Transit Systems, particularly Rail based systems such as Namo Bharat are highly capital-intensive with long gestation periods. In addition, such systems incur significant recurring expenditure for operations and maintenance. However, such systems generate large economic returns over a period of time and are necessary for long term and sustainable development of any region. These systems may not be financially viable on transit (fare) based revenue alone and require other sources of revenue and government support for financial sustainability.

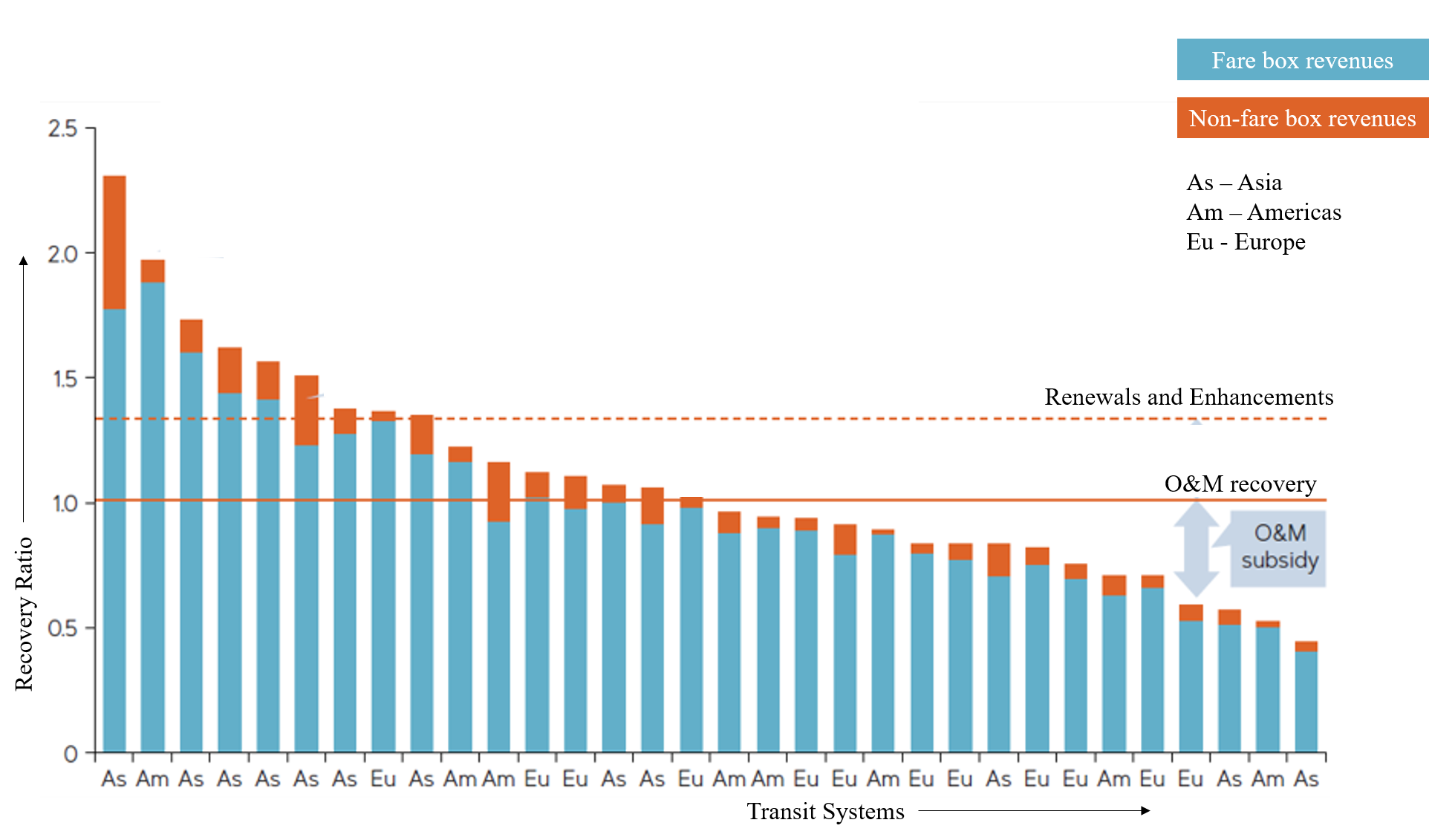

Most Urban Transit Systems around the world are unable to cover their operating costs from fare box revenues, let alone the capital expenditure. The capital expenditure for these projects is often financed by borrowings from external agencies and the repayment of debt impacts overall financial sustainability. Transit Agencies are, therefore, increasingly looking for ways to augment revenues from other sources – both conventional and innovative, to improve their financial sustainability.

Recovery Ratios is defined as the ratio of total revenues (fare + non fare) to the operating expenses. The figure below shows the Recovery Ratios for different rail-based mass transit systems across the world. A shortfall occurs when revenues are not enough to cover the operational costs. This is a significant impediment for maintaining service quality and addressing commuter aspirations.

Transit Oriented Development (TOD) is a policy intervention by the Government for the integrated planning of Transit Nodes.

TOD integrates land use and transport planning and aims to develop planned vibrant sustainable urban growth centres, having walkable and liveable communes with high density mixed land-use. Citizens have access to open green and public spaces and at the same time transit facilities are efficiently utilized.

TOD Policies allow for additional development rights in the “Influence Zones” of the Transit project in addition to allowing for a mix of uses. This additional development right in conjunction with integrated planning (focused on public transit usage) increases the ridership of the Transit System.

Source : Sec. (2) National TOD Policy (2017)

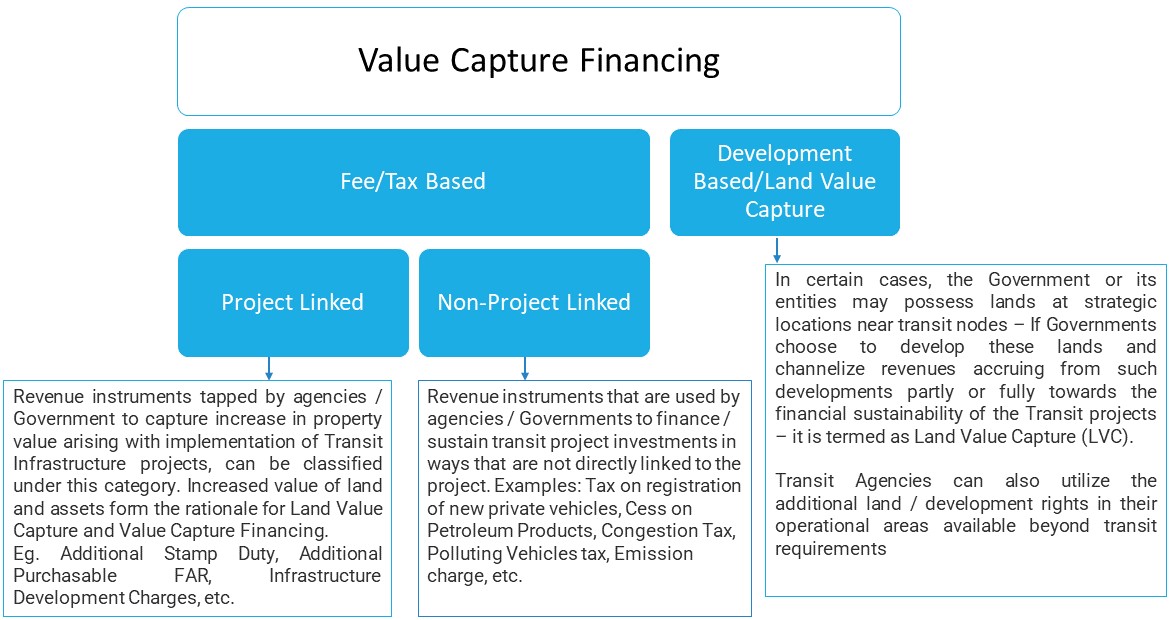

Value Capture Financing (VCF) is defined as a public financing method by which governments (a) trigger an increase in land values via regulatory decisions or infrastructure investments, (b) institute a process to share this land value increment by capturing part or all of the change and (c) use these proceeds to finance infrastructure investments (e.g. investments in transit and TOD), any other improvements required to offset impacts related to changes (e.g. densification) and / or implement public policies to promote equity (e.g. affordable housing, etc.)

VCF aims to capture a portion of the unearned / windfall gains accruing to private players owing to Government interventions by imposing new taxes / fees or enhancing existing taxes / fees in the catchment of the project where such revenues accrued are utilized for the financial sustainability infrastructure project.

Source: Sec. (2) National VCF Policy Framework (2017)

National TOD Policy states that “In TOD influence zones, land value capture can be done through enhanced or additional land value tax or one time betterment levy, development charges or impact fee, transfer of development right (TDRs), or other such mechanisms which have been adopted in various states across the country and abroad”. It also states that Land Value Capture can be used as a mechanism to finance the required upgradation of infrastructure and amenities within the influence zone and expansion of the public transport system.

TOD policy should be notified as part of the Master Plan/Development plan of the city. To ensure that the infrastructure created in the influence zone is provided in a planned manner, the Urban Local Bodies (ULBs) and the concerned authorities/agencies should prepare a comprehensive plan integrating all the utilities, physical infrastructure and essential facilities such as roads, sewers, drainage, electric lines, green spaces, police post, fire post, electric sub-stations, etc.

The National TOD Policy also states that a TOD fund should be created for funding the infrastructure upgradation/ maintenance, enhancement of viability of transit systems, and should be in the form of an escrow account, from which financing is provided to various agencies for the identified activities and the balance can be used by the ULBs for other development purposes such as public transport expansion.

The VCF Policy Framework issued by the Ministry of Housing & Urban Affairs, aims to encourage and enable Central Government, States/ULBs to use appropriate VCF methods for generating resources for new and existing infrastructure projects in urban areas.

The Ministry of Housing and Urban Affairs provides guidance to State Governments and Union Territories to leverage their assets, and in particular make use of underutilized resources such as land to finance infrastructure.

At the time of initiation of the project, the rules and regulations governing Value Capture in the State need to be studied and possibilities of applying existing VCF methods need to be examined.

After finalizing the project location, the area of influence of the project for applying the Value Capture tool needs to be delineated. The area of influence of the project will be the area in which land and property values are expected to increase due to project location. The starting point is the value impact assessment in the area of influence, which should form a part of the Detailed Project Report (DPR). Further, stakeholders who will benefit from the setting up of the project will have to be identified and consultations held with them right from the stage of project initiation.

The Value Capture methods for funding a project need to be identified and these methods have to be put in place by the State Governments and ULBs which will include the type and number of VCF tools to be applied, methods of assessing, levying and collecting the incremental value generated, time period during which the VCF tools will be in operation, etc. Moreover, the funds collected from the application of Value Capture methods will have to be placed in a separate account and the way of using the funds by Governments and their agencies will have to be agreed upon. The Value Capture method for the project should be implemented and an efficient mechanism for monitoring of fund management put in place. Regular monitoring and evaluation of the project progress will have to be established and put in the public domain.

As per the National Metro Rail Policy, for enhancing the viability of Metro / MRTS Rail Projects, the commitment by the State Government to adhere the guidelines issued by the Central Government with respect to TOD and adoption of VCF framework should be an integral part of the project proposal.

Transfer of the financial benefits accruing in the influence zone of the metro alignment on account of the TOD policies and VCF framework directly to the Special Purpose Vehicle (SPV) / agency implementing the metro rail is mandated.

The project report should specify the proposed quantum of such benefits being transferred to the project. This requirement would form a mandatory part of all metro rail project proposals.

The policy encourages high-capacity public transport systems be setup through the mechanism of Special Purpose Vehicle (SPV) and focuses on the principle that the Government should provide the infrastructure, but the beneficiaries (indirect / direct users within the city) must pay for the operating costs and rolling stock.

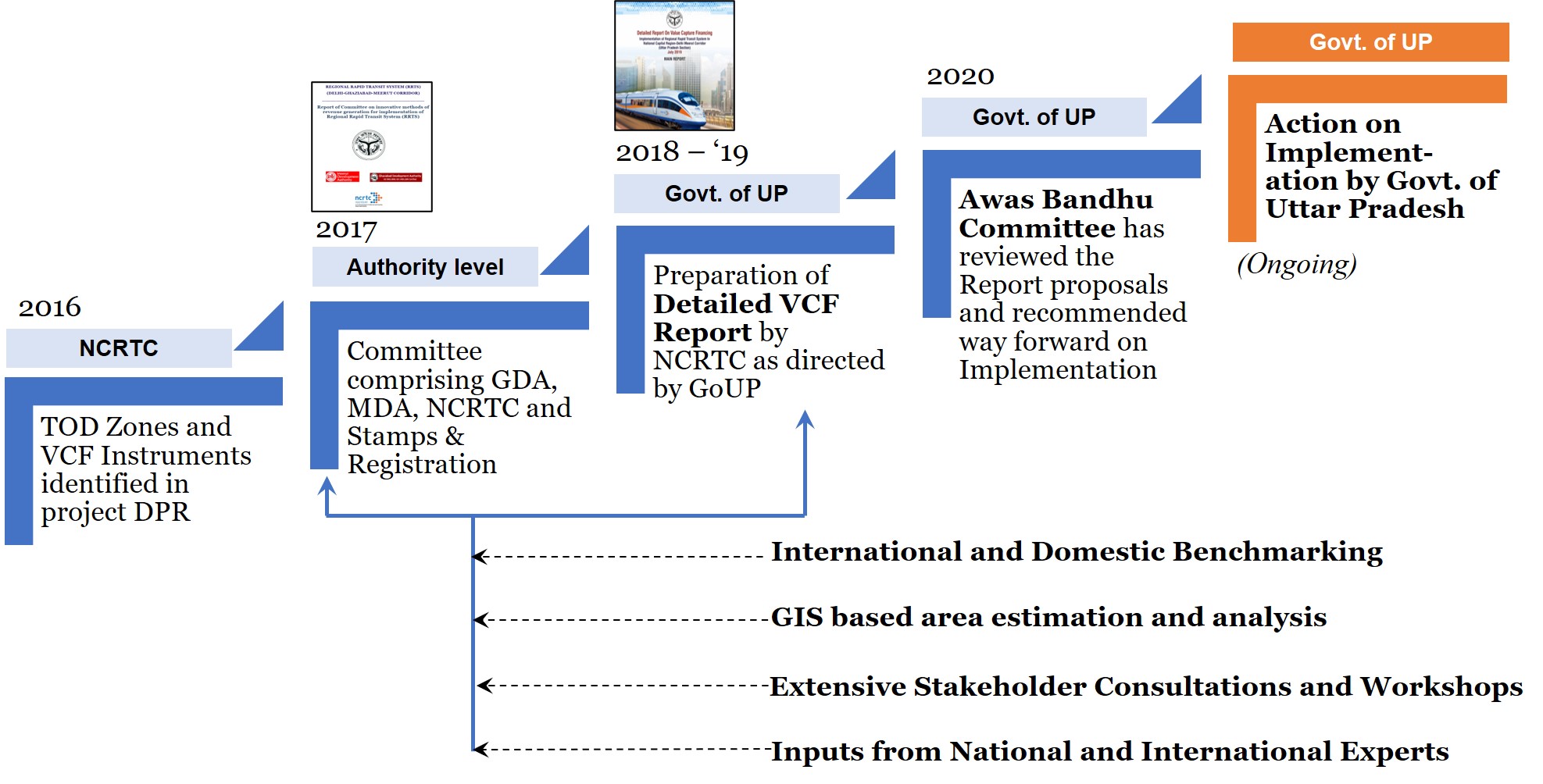

In March 2019, the Government of India, in its Sanction Letter for the Delhi Meerut Namo Bharat Corridor, directed NCRTC and the participating State Governments to take action through implementation of VCF & TOD for the financial sustainability of the Namo Bharat project. NCRTC has been actively pursuing VCF and TOD for increasing non-farebox revenues for the overall financial sustainability of the Namo Bharat System. Extensive consultations have been held with a diverse range of stakeholders including Ghaziabad Development Authority (GDA) & Meerut Development Authority (MDA), District Administrations, Revenue, PWD, Transport, Stamps and Registrations, Industries Departments, Global and Domestic subject matter Experts, Private Sector Players, etc.

Workshop on TOD and VCF, 15th June 2019

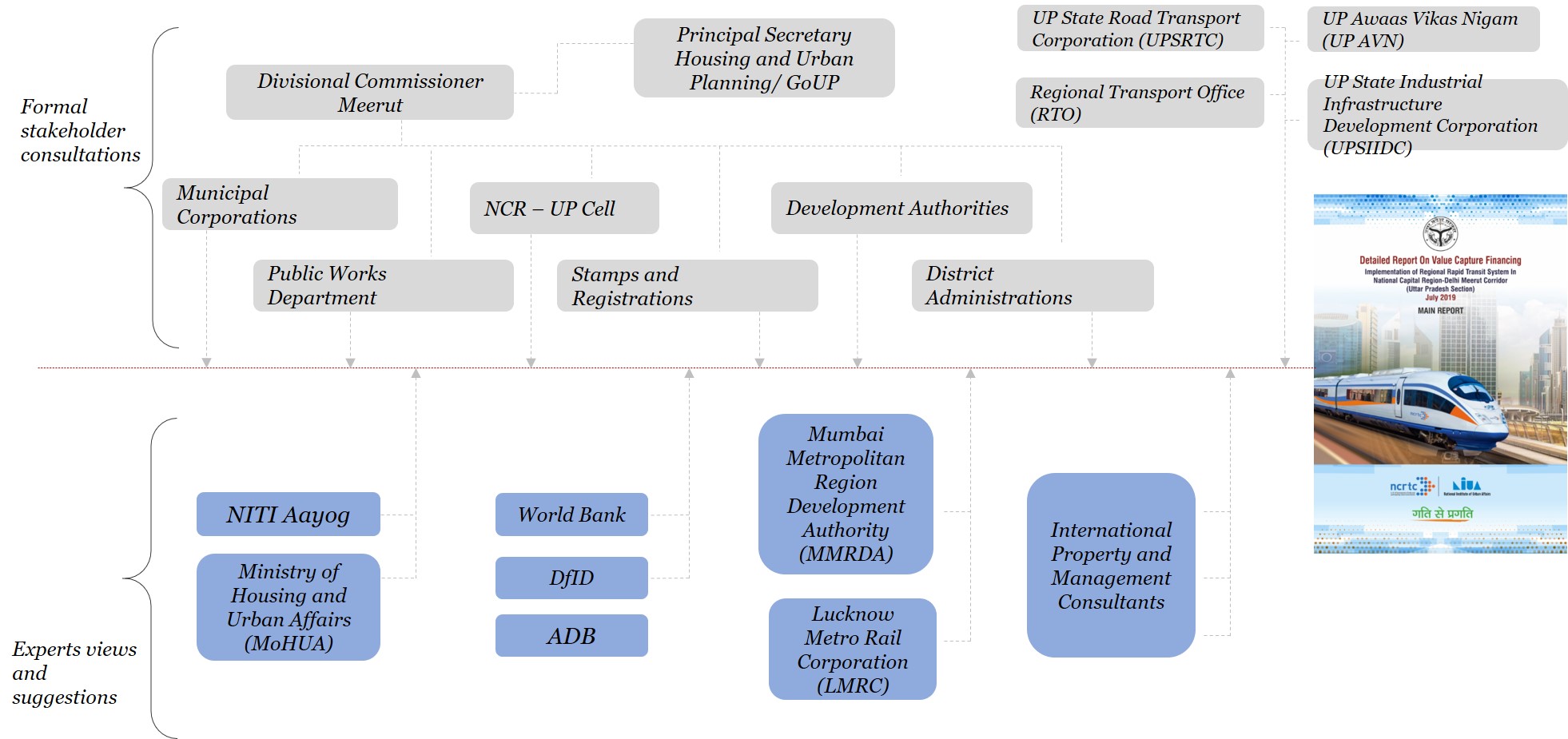

NCRTC conducted a workshop on implementation of Transit Oriented Development (TOD) and Value Capture Financing (VCF) for stakeholders and agencies of Government of Uttar Pradesh (GoUP). This half day workshop was arranged at Hotel Radisson Blu, Ghaziabad on June 15th, 2019. The objective of this workshop was to appraise and update local governing authorities and departments of Government of Uttar Pradesh on various aspects of TOD and VCF implementation, sharing of successful Indian and international examples, critical success factors, etc.

Apart from the Secretary, Infrastructure & Industrial Development, GoUP and Divisional Commissioner, Meerut Division, officials from the Development Authorities, District Administrations, Municipal Corporations, Stamps and Registration Department, Public Works Department (PWD) and Regional Transport Office (RTO) attended the workshop. Other attendees included officials from UP Awaas Vikas Parishad (UPAVP), Uttar Pradesh State Road Transport Corporation (UPSRTC), Uttar Pradesh State Industrial Development Corporation (UPSIDC) and Lucknow Metro Rail Corporation (LMRC). Officials from NITI Aayog and National Institute of Urban Affairs (NIUA) were also represented. Multilateral Institutions and overseas lending institutions like the World Bank, Asian Development Bank (ADB) and Department for International Development (DfID) participated as speakers or as special invitees.

In addition, eminent speakers from organizations such as World bank, MMRDA, DfID, KPMG, PwC and Knight Frank highlighted Indian and International Experiences relating to the topics. The speakers discussed important issues such as the need for a sound and timely legal framework for VCF, the need for a single SPV for managing TOD development, clear and contextual understanding of market appetite and intensive engagement of the private sector. Multiple speakers raised the need and importance of

developing integrated multi-modal hubs and planning for the last mile connectivity to ensure success of TOD projects.

The workshop concluded with a consensus that implementation of TOD and VCF mechanisms in a timely and effective manner is highly crucial both to the State Government and NCRTC. A positive feedback was received from all participants on the effectiveness of the exercise. The feedback also suggested that further capacity building efforts in this regard would be helpful.

With Transit Oriented Development (TOD), Namo Bharat project will lead to improvement in the quality of housing, jobs access and transportation, yield other social benefits, and lead to the emergence of important commercial, cultural, institutional or residential developments along the transit corridors. This, in turn, will lead to an appreciation in land value in the neighbourhood.

Since this appreciation will result from public investments and policy initiatives along the transit corridor, under the framework, NCRTC is assisting the concerned State Governments to explore innovative sources of revenue (non-fare box) by seeking a share of the enhancement in value through Value Capture Financing (VCF) tools and instruments along with conventional revenue to enhance financial sustainability of the project.

NCRTC has been actively exploring avenues for increasing non-farebox revenues through implementation of TOD, Land Value Capture (LVC) and VCF for the financial sustainability of the Namo Bharat project and is also actively pursuing applicable international best practices for the implementation of these initiatives.

The State Government of Uttar Pradesh (Delhi – Meerut Namo Bharat Corridor) is actively supporting the initiatives of NCRTC. Value Capture Instruments like Additional Purchasable FAR, Special Amenity Fees, Change of Land Use Charges and Additional Stamp Duty are under active consideration of the State Government.

For the proposed Delhi – Gurugram – SNB Namo Bharat Corridor, the Government of Haryana in their approval letter for the DPR, mandated that Additional FAR be applicable in the Influence Zone of the Project (1.5 km radius). The Haryana TOD Policy already provides for the applicability of other VCF instruments like Infrastructure Development Charges, Infrastructure Augmentation Charges, Change of Land Use, etc.

Development on land parcels in the vicinity of transit projects. Example- Entry / Exit structures, stabling yard, depots, spaces under and above the station box and other land parcels associated with the of the transit system .

Utilization of paid/unpaid areas within the station box. Example- Kiosk, ATMs, small shops etc.

High passenger densities and frequent service present an opportunity for marketing to a captive audience through well placed advertising messages in the stationary and mobile assets of the transit system.

Digital / Telecom / Multimodal Integration / Parking / etc.

The Asian Development Bank is providing for Technical Assistance in the implementation of both Conventional and Innovate sources of revenue for financial sustainability of the Delhi – Ghaziabad – Meerut Namo Bharat Corridor. Outcomes under the Technical Assistance program include –

Value Capture Financing – Implementation of VCF for the Namo Bharat including support to Government of Uttar Pradesh through NCRTC, in establishment of an enabling policy and regulatory framework, through updating of necessary Acts / Rules, including relevant policies, in co-ordination with key Government stakeholders.

Transit Oriented Development – Preparation of TOD Based Masterplans for pilot nodes along the Delhi Meerut Namo Bharat including infrastructure assessment, traffic and multimodal integration and detailed design briefs for TOD development at key identified Namo Bharat station locations.

Property Development – Detailed Real Estate Feasibility studies and Transaction Structuring for the identified nodes along the Delhi Meerut Namo Bharat, including competitive benchmarking, demand assessments, development of project proposals, business plans and transaction documents.

In Station Commercial and other revenue generation Support to NCRTC in identifying potential for business opportunities, preparation of feasibility studies, business plan and implementation plan including drafting of transaction and contractual documents.

Promoting TOD in the State of Uttar Pradesh – Comprehensive Engagement Strategy for ADB and other development partners to accelerate TOD & VCF.

Mukut is a Project Development Professional with over 30 years’ experience in planning and implementation of urban sector infrastructure projects. His recent Experience relates to Transit Oriented Development and Value Capture Financing.

Abhaya is Senior Partner with M/s. Ernst & Young India in the Government and Public Sector business. He brings more than 30 years on experience including strategic advisory and transaction management relating to infrastructure and PPP projects.

Goonmeet is Founder Partner at M/s. Design Forum International with over 25 years’ experience in Masterplanning, Mixed Use and Retail, Group Housings, offices, and IT Parks.

Saurabh currently heads pan-India Advisory Practice of M/s. Knight Frank India Pvt. Ltd. He has about 22 years’ experience in the field of Infrastructure Development, Financial and PPP Advisory, Transaction Advisory, Procurement and development of land and real estate monetization strategies as property development expert.

Saurabh is co-founder and Senior Partner at M/s. Auctus Advisors and manages their urban transportation business. He brings more than 20 years of experience related to enhancing the financial value and performance in metros, airports, bus terminals and railways through commercial revenue sources and real estate monetization.

Copyright @2016 – www.ncrtc.in. All Rights Reserved. All images on the website are representations. The actual assets may be different…